As Australia continues to grapple with housing affordability and supply, Build-to-Rent (BTR) developments are becoming more prevalent. A Property Council of Australia report released in April 2023 estimated the BTR sector accounts for roughly 0.2 per cent of Australia’s residential housing, compared to 5.4 per cent in the UK and 12 percent in the US. For developers, builders and investors, interest in BTR is increasing due in no small part to perceptions that office rental returns have fallen since the onset of COVID and remote working.

Earlier this year, the federal government set a target of building an additional one million homes within five years. Growth in BTR will prove to be vital in helping achieve this target.

But how does BTR differ from the traditional build-to-own model? Basically, with residences designed and constructed with the specific purpose of being rented rather than sold to individuals, it is the developer who retains ownership, and manages and maintains the buildings – sometimes with the participation of an investment fund, or pool of investors. The aim of BTR is to encourage long-term renters, so building amenities (including domestic appliances, cleaning, and maintenance) may be more extensive than a normal strata/build-to-own arrangement.

Tenants often have greater flexibility, with the ability to switch between residences within the same complex to accommodate their changing circumstances. An element of affordable housing may also be included in the project. WTW is aware of a host of developments that have commenced in Sydney and Melbourne. One major project in Melbourne, in inner-suburban Footscray, comprises 700 dwellings and a mix of commercial and complementary retail and entertainment facilities.

A different insurance landscape

BTR developments are retained by the builder or developer, which places them outside of strata regulation under the various state-based registration schemes. Nevertheless, many traditional strata-type insurance cover components still apply – including property cover for the building, associated liability, shared or common contents, machinery breakdown for air conditioners and lifts, loss of rent for the developer and office bearer’s liability for elected representatives.

However additional elements may also be required, including for supplied apartment contents, or longer than 12 months loss of rent cover.

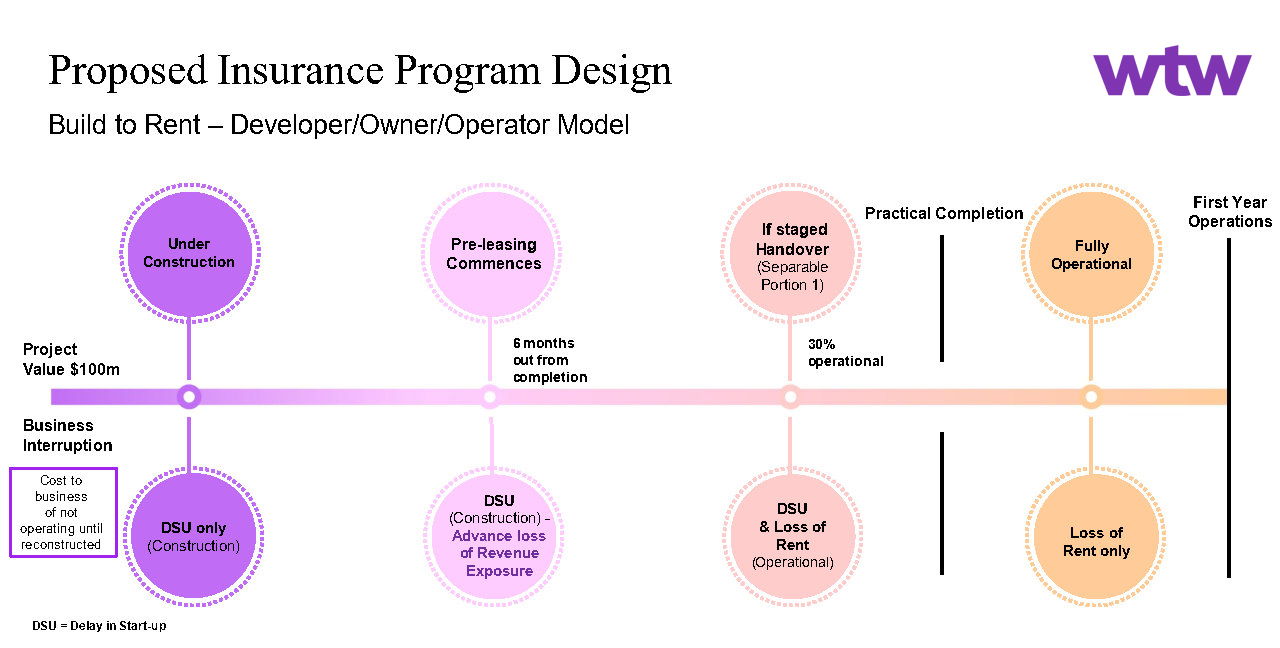

From a risk management viewpoint, securing cover which includes the construction phase of the building itself (along with any staged or partial handovers) through to completion and then into occupation as an operating community hub has advantages. It offers a seamless transition between the otherwise separate insurances and demarcation issues are avoided during handover and the maintenance defects period.

Importantly, this arrangement achieves certainty in costs along with cover. It can also incorporate delay in start-up cover to protect potential revenue streams.

Here’s how the BTR model works:

What covers need to be put in place?

WTW has developed an Australian-first “all of life” solution, with a flexible model to ensure the various components of the development are covered, with optional extensions available, subject to project details and needs. The solution is a holistic insurance program for BTR developers, owners and operators who should satisfy themselves that they have appropriate cover for:

-

Contract Works/Property Cover – physical damage to property under construction and subsequent use, including contents

-

Existing Property – where a development includes an existing structure

-

Plant and Equipment – a developer/builder’s own or hired P&E,

-

Advanced Consequential Loss – loss of future insurable revenue, fixed costs or debt servicing costs should the project be delayed by an insured peril including claims preparation costs and cost to reduce interruption losses

-

Accidental Damage, Burglary and Fire losses once the building is complete

-

Liability – third party property damage or personal injury arising out of the construction and occupation of the building

-

Loss of Rent – costs incurred to abate rent during any period of disruption, reletting costs following insured damage including machinery breakdown

-

Machinery Breakdown – breakdown cover for specified items of machinery.

BTR has a significant role to play to address Australia’s housing shortfall but, particularly in an era where there is a host of macro challenges, including supply chain disruption, cost inflation and credit risk, it is crucial that builders and developers can protect their construction phase and ongoing investment through the right insurance program.

WTW is a proud corporate partner of the AIB, supporting members with insurance broking for all general lines of construction insurance and a wide range of covers of value to the industry, including workers’ compensation, home warranty insurance and cyber risk solutions. If you’d like to discuss how your organisation can better manage and mitigate risk, your insurance options, or a chat about your current program, please reach out to:

Michael Cook

0404 446 962

[email protected]